sacramento county tax rate

View the E-Prop-Tax page for more information. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates.

California S Highest In The Nation Gas And Diesel Taxes California Globe

The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local.

. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and. Sacramento county 2019-2020 compilation of tax rates by code area code area 03-041 code area 03-042 code area 03-043 county wide 1 10000 county wide 1 10000 county wide 1. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the.

The December 2020 total local sales tax rate was also 7750. 075 lower than the maximum sales tax in CA. 2017-2018 compilation of tax rates by code area sacramento county code area 03-020 code area 03-021 code area 03-022 county wide 1 10000 county wide 1 10000 county wide 1.

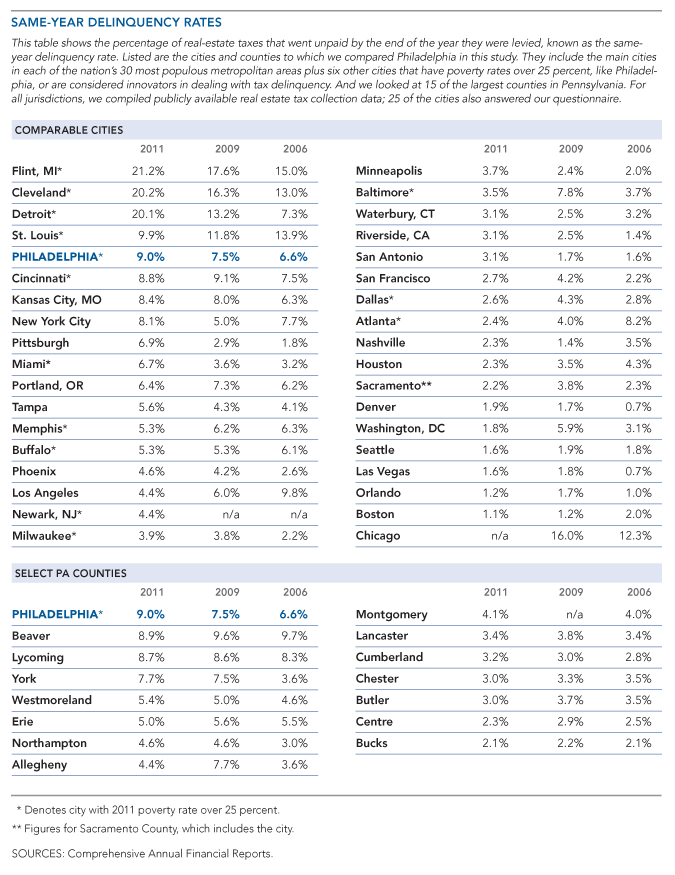

1788 rows Sacramento. This is the total of state county and city sales tax rates. A delinquency penalty will be charged at the close of the delinquency date.

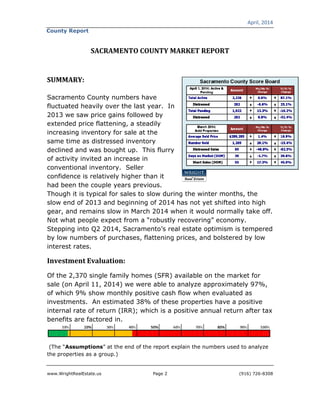

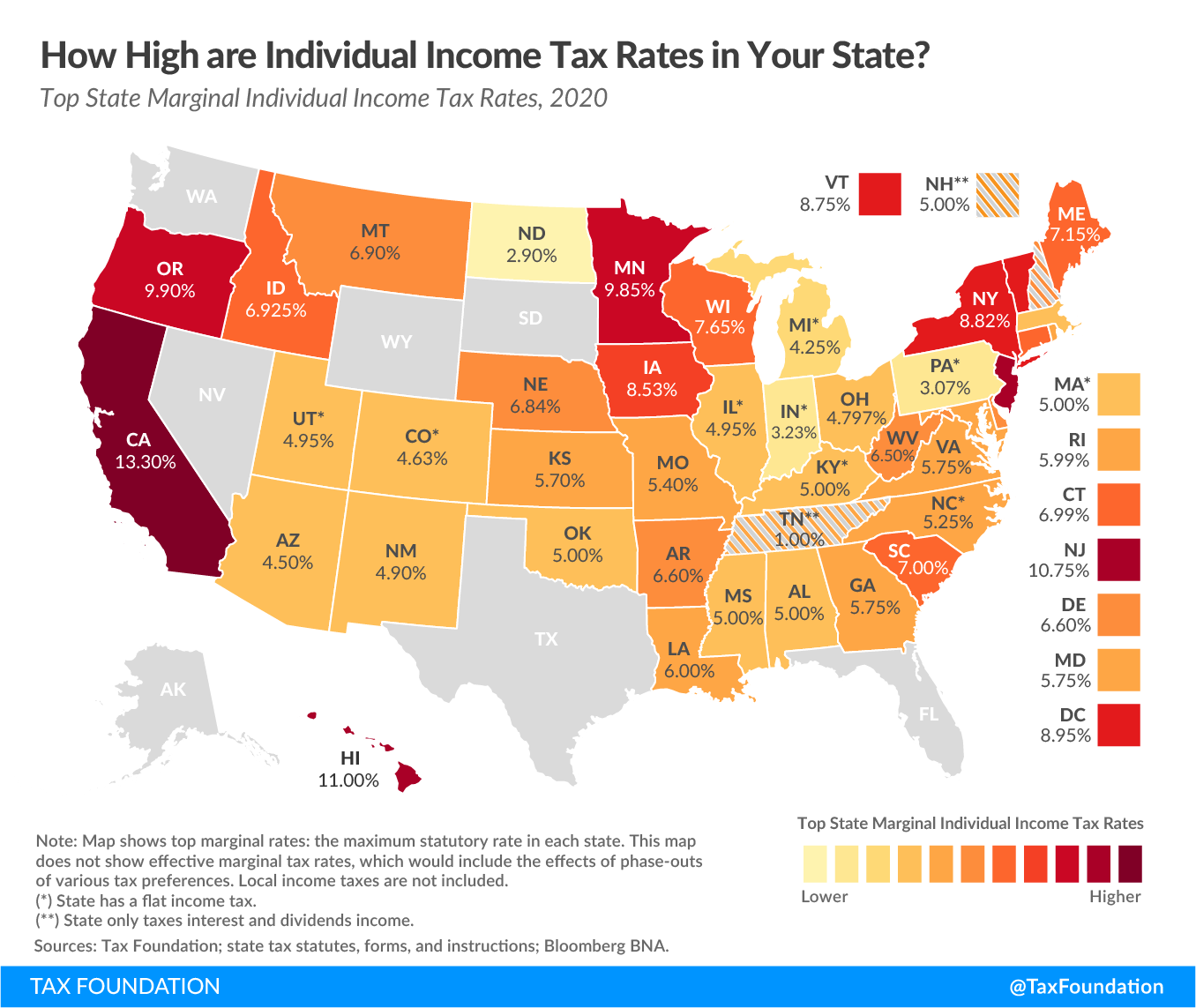

The current total local sales tax rate in Sacramento County CA is 7750. Has impacted many state nexus laws and sales tax collection. The overall property taxes in California are below the national average at 73.

Tax Collection Specialists are. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Sacramento County CA Sales Tax Rate.

Download all California sales tax rates by zip code. Tax Rate Areas Sacramento County 2022. The Sacramento County sales tax rate is.

Sacramento County Sales Tax Rates for 2022. Compilation of Tax Rates by Code Area. Please make your Property tax payment by the due date as stated on the tax bill.

Thus its largely just budgeting first setting an annual. 33 rows California has a 6 sales tax and Sacramento County collects an additional 025 so the. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

2021-2022 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1. As calculated a composite tax rate times the market worth total will show the countys whole tax burden and include your share. The 2018 United States Supreme Court decision in South Dakota v.

So how does the Sacramento county property tax rate differ from the state and national rates. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and. Sacramento County collects on average 068 of a propertys.

What is the sales tax rate in Sacramento California. The minimum combined 2022 sales tax rate for Sacramento California is. Emerald Hills Redwood City 9875.

California Sales Tax Rate Clip Art Library

Arden Arcade California Wikipedia

California Sales Tax Rate Rates Calculator Avalara

Delinquent Property Tax In Philadelphia Stark Challenges And Realistic Goals The Pew Charitable Trusts

Taxation In California Wikipedia

Sales Tax Rates Finance Business

California S Corporate Income Tax Rate Could Rival The Federal Rate Tax Foundation

Sacramento County Ca Property Tax Search And Records Propertyshark

A Slew Of New Tax Measures Coming In 2022 Daily Breeze

Boe Unveils New Sales Tax Tool Nevada City California

Three Consecutive Years Of Lowered Property Taxes Sacramento Appraisal Blog Real Estate Appraiser

County Cannabis Tax Measure Fails News Galtheraldonline Com

Local Marijuana Bans In California Keep Illicit Market Alive And Block Revenue Study Shows Marijuana Moment